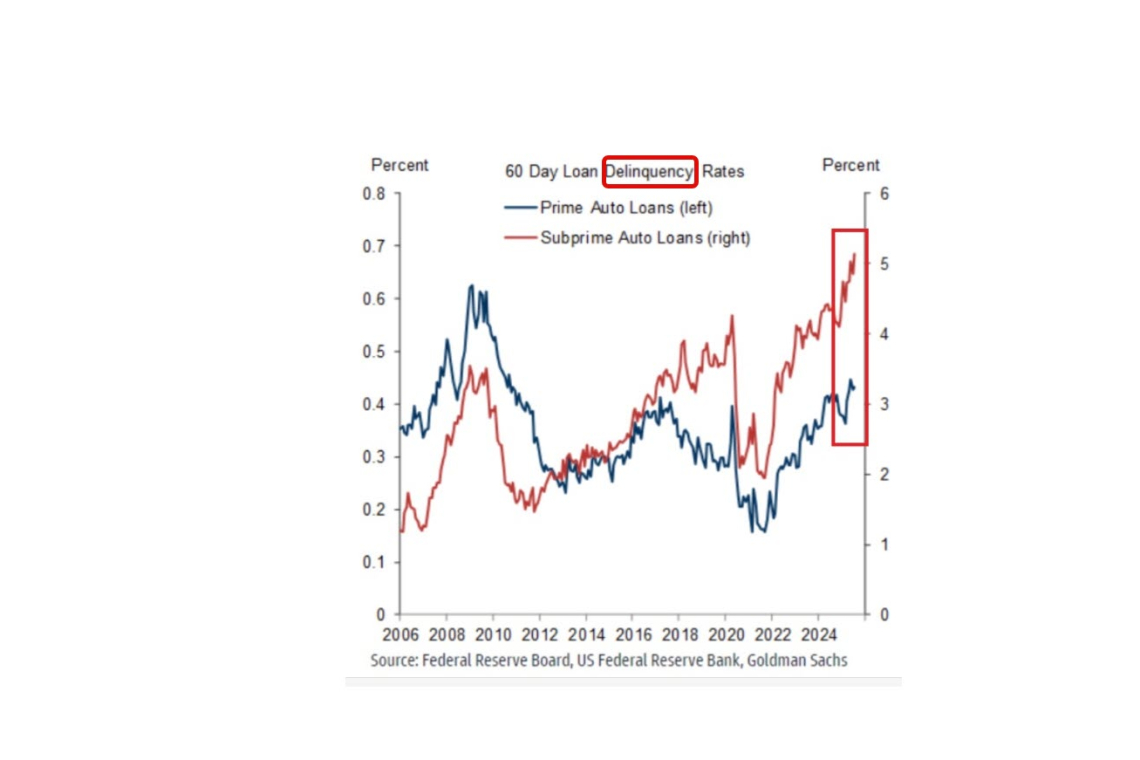

The car market bubble is bursting: Subprime auto loan delinquency rates have now surpassed 5% for the first time in history.

The 60-day delinquency rate for subprime auto loans has more than DOUBLED over the last 3 years. Delinquency rates are now ~1.5 percentage points above the 2008 Financial Crisis peak.

. . . it gets worse . . .

At the same time, prime auto loan (the most creditworthy people) delinquencies rose to their highest in 15 years.

Meanwhile, the total value of auto loans in the US jumped $13 billion, to a record $1.66 trillion in Q2 2025.

An auto debt crisis is brewing.