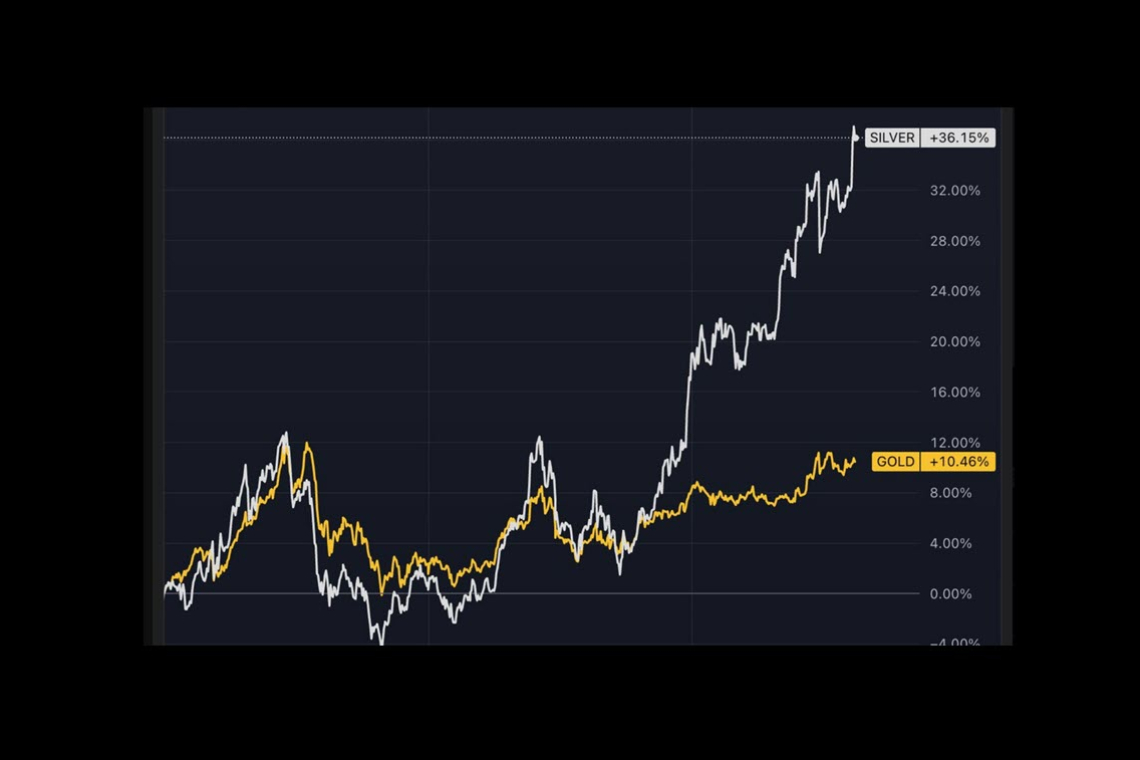

Silver's +36% price surge versus gold's +10% gain in late 2025, based on a TradingView chart, signals a rare decoupling where silver outperforms due to industrial demand outpacing monetary trends.

The chart below shows the spike in Silver and the typical, usual, pricing of Gold. Big changes have taken place:

Historically, gold-silver ratios average 40-60:1 but spiked to 80+ during manipulations; the current 65:1 ratio, with silver at $66/oz and gold at $4,340/oz as of December 17, 2025, suggests tightening supply constraints per recent Kitco analysis.

This decoupling challenges paper market controls, as physical silver deficits—projected at 200 million ounces annually by Silver Institute data—drive prices, potentially amplifying a broader precious metals rally into 2026.