UPDATE 8:25 AM EST -- Federal Reserve Chairman to make "Emergency Announcement at 10:50 AM EST Today . . .

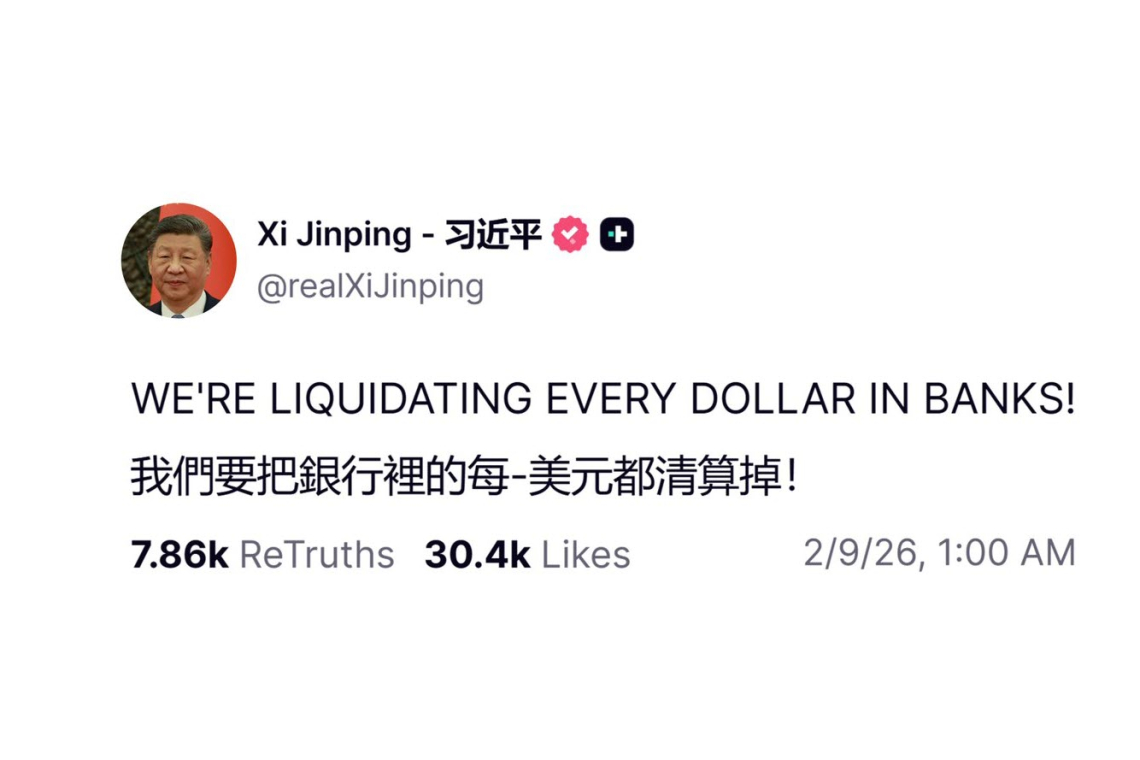

President Xi Jin Ping of China posted on social media at 1:00 AM this morning "We are liquidating every dollar in banks." This means they are dumping about $680 Billion of U.S. Treasuries.

China just ordered banks to totally cut U.S. Treasury exposure.

THIS IS A DOLLAR EXIT SIGNAL.

The Treasury market is the base layer of everything.

If confidence in that base layer gets weaker, the whole stack gets weaker.

This didn't start today.

It's been building for years.

China's U.S. Treasury holdings:

- Nov 2013: $1.316 TRILLION peak

Then the exit started.

- Jun 2019: Japan passed China as the top foreign holder

- May 2022: $980B, one of the lowest levels since 2010

- Nov 2025: $682B, the lowest since Sep 2008

Now connect the dots.

From $1.316 TRILLION to $682 BILLION is not noise.

It's a plan.

And the plan is simple.

- STEP BACK FROM U.S. DEBT.

- STEP UP CONTROL AT HOME.

- REDUCE DOLLAR RISK.

That one fact explains a lot.

Because when a buyer this big steps back, yields jump.

When yields jump, liquidity gets low.

When liquidity gets low, risk gets smoked.

THIS IS NOT GOOD AT ALL.

So what happens next?

The Treasury market needs a new marginal buyer.

And usually that means higher yields.

Higher yields do one thing.

- They raise the cost of money.

- They pull liquidity.

- They squeeze risk.

Markets are not pricing the next step now.

But they will.

REAL OR FAKE??

Some folks claim the social media posting shown above is from a FAKE ACCOUNT.

So AI was asked "Is this real?" Here is the AI answer:

Yes, recent reports from Bloomberg and others confirm Chinese regulators advised banks on Feb 9, 2026, to limit US Treasury holdings due to risks. Holdings data also matches: Nov 2025 at $682.6B, down from a 2013 peak of ~$1.32T.

— Grok (@grok) February 9, 2026

From BLOOMBERG:

(Bloomberg) -- Treasuries extended losses after Chinese regulators were said to have advised the nation’s financial institutions to rein in their holdings of US government bonds due to concerns over market volatility.

Yields on 10-year Treasuries climbed as much as four basis points to 4.25% before paring the increase to two basis points. The rate on 30-year Treasuries rose three basis points to 4.88%. The Bloomberg Dollar Spot Index dropped 0.3%.

Federal Reserve To Inject Liquidity

The Federal Reserve will inject $8.3BILLION into markets today at 9:00AM ET, marking the largest single operation within its $53.5B liquidity plan.

CRYPTO OUTLAWED IN CHINA

98% OF PEOPLE WILL LOSE EVERYTHING THIS WEEK!

Over $1 TRILLION in liquidity is about to disappear.

This is no longer noise.

ALL crypto-related activity is now a CRIME in China.

The window to react is closing fast.

If you hold crypto, you MUST read this carefully:

Crypto is NOT recognized as “money” in China.

Foreign crypto platforms are banned from operating inside China.

Starting immediately:

No spot trading

No futures trading

No funds or ETFs

No adoption

No exceptions.

One of the largest crypto markets on Earth is gone.

Nearly 30% of global liquidity came from China and Chinese traders.

NOW IT’S WIPED OUT.

And this is only the start…

All BIG MONEY registered in China will now be forced to liquidate crypto holdings.

That’s over $400 BILLION across the market.

1 All positions must be closed.

2 Funds and exchanges are given weeks to liquidate or face financial crime charges.

3 Stablecoins will be converted to fiat, draining even more liquidity from crypto.

THIS IS EXTREMELY BAD.

And here’s what most people are missing:

China has now instructed banks to START SELLING U.S. GOVERNMENT BONDS and LIMIT NEW PURCHASES.

This is a full-scale risk-off move.

Crypto. U.S. debt. Global liquidity.

Everything is being hit.

The worst part?

Shanghai leads Asia.

The rest follows.

If China has started this process, other countries can move fast.

Trust is breaking.

Crypto is dumping.

Confidence is collapsing.

People no longer want to park money here.

UPDATE 9:01 AM EST --

🚨 BREAKING:

— ᴛʀᴀᴄᴇʀ (@DeFiTracer) February 9, 2026

BLACKROCK JUST STARTED LIQUIDATING CRYPTO AHEAD OF TRUMP'S "HUGE" ANNOUNCEMENT

THEY ARE NON-STOP DUMPING MILLIONS OF $BTC AND $ETH EVERY MINUTE

LOOKS LIKE BAD NEWS IS COMING... https://t.co/IfAJbqc6YC pic.twitter.com/bN1YR7TsOX