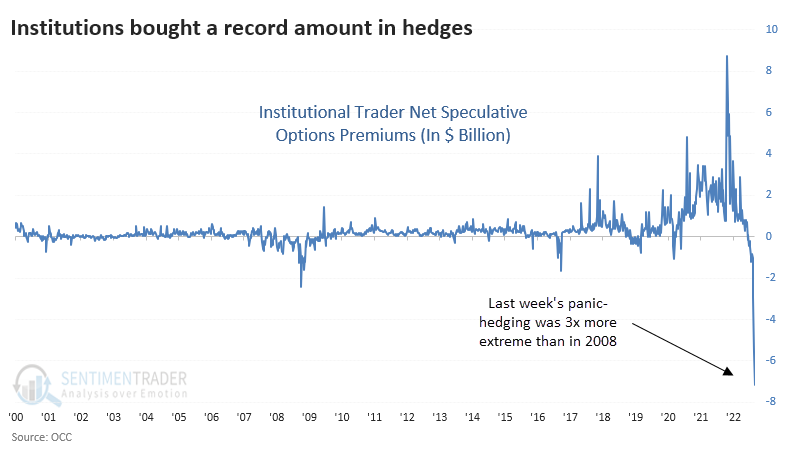

Every once in awhile, there's a chart that just blows your hair back.

In years of doing this, none stand out like this one.

Last week, institutional traders bought $8.1 billion worth of "put" options. They bought less than $1 billion in calls.

For what it's worth, this is 3x more extreme than 2008; when everyone who mattered **knew** things were going to crash . . . and then did crash.

Is this signaling "the mother of all crashes?" Maybe. But if it happens, it will by a HYPER-INFLATIONARY CRASH through demand destruction.

The way prices are rising, and costs of production are increasing, people are being priced out of buying and companies are being priced out of operating. Everything might just . . . stop.

In related financial news, the average 30-year mortgage rate climbed to 5.89%, the highest level since . . . 2008 . . . . according to new data published Thursday by Freddie Mac.

Mortgage rates briefly declined for a period this summer even as the Federal Reserve raised the key interest rate to fight inflation. Markets have been closely watching the Fed's moves since the interest rate hikes began in March.

"Rates are reacting to Federal Reserve Chair Jay Powell’s comments following last week’s jobs report in which he reiterated his unwavering focus on bringing inflation down to its 2% target level," Lisa Sturtevant, the chief economist at Bright MLS, a real estate data firm, said in an email.

In remarks Thursday morning, Powell signaled the Fed intends to keep rates higher for longer.