Silicon Valley Bank online banking system and mobile services are now unavailable for business clients. The stock is down over 80% yesterday alone.

In 2021 SVB saw a mass influx in deposits, which jumped from $61.76bn at the end of 2019 to $189.20bn at the end of 2021.

As deposits grew, SVB could not grow their loan book fast enough to generate the yield they wanted to see on this capital. As a result, they purchased a large amount (over $80bn!) in mortgage backed securities (MBS) with these deposits for their hold-to-maturity (HTM) portfolio.

97% of these MBS were 10+ year duration, with a weighted average yield of 1.56%.

The issue is that as the Fed raised interest rates in 2022 and continued to do so through 2023, the value of SVB’s MBS plummeted. This is because investors can now purchase long-duration "risk-free" bonds from the Fed at a 2.5x higher yield.

This is not a liquidity issue as long as SVB maintains their deposits, since these securities will pay out more than they cost eventually.

However, yesterday afternoon, SVB announced that they had sold $21bn of their Available For Sale (AFS) securities at a $1.8bn loss, and were raising another $2.25bn in equity and debt. This came as a surprise to investors, who were under the impression that SVB had enough liquidity to avoid selling their AFS portfolio.

Here's what happened to the banks stock price:

This is big, a woman I spoke to is an MBA at a small tech company. She said her company was freaking out and was trying to pull money out all day and all the transactions are still “pending”. There are so many of these smaller tech companies out there that aren’t even profitable yet and they could easily go belly up over this.

This goes way beyond just some banking contagion.

401-K Withdrawals being Delayed MONTHS!

Word from money giant VANGUARD is that people with 401-k's who have been trying to make "Hardship withdrawals" for the past two months, have been stymied by VANGUARD.

According to one customer, he has been trying to take money out of his 401-K to pay down some medical debt. People with 401-K's can make what are called "Hardship Withdrawals" to get some cash during troubled finances, and minimize the tax impact.

Instead of giving this one man his money, VANGUARD demanded to see the Explanation of Benefits (EOB) from his health insurance! The guy sent it, showing exactly the medical procedure he had done, the charges, what the Insurance paid, and what his portion is. That was two months ago. According to the man, VANGUARD has still not sent his money and each time he calls or writes, he is told either "We need the EOB" or "The transaction is still pending."

Result: No money from VANGUARD!

banks are hurtin..

SIVB -60.41%

BKX -7.70%

GS -2.06%

MS -3.86%

CUBI -8.93%

FRC -16.51%

SASR -7.13%

NYCB -6.33%

FFWM -8.80%

ALLY -7.00%

DCOM -2.15%

PPBI -7.50%

PB -4.51%

CLBK -3.54%

CMA -8.01%

FHN -1.97%

Moreover, BCS -3.60%

Watch Barclay's.

Deutsche Bank collapse 10% before slightly recovering in opening trading

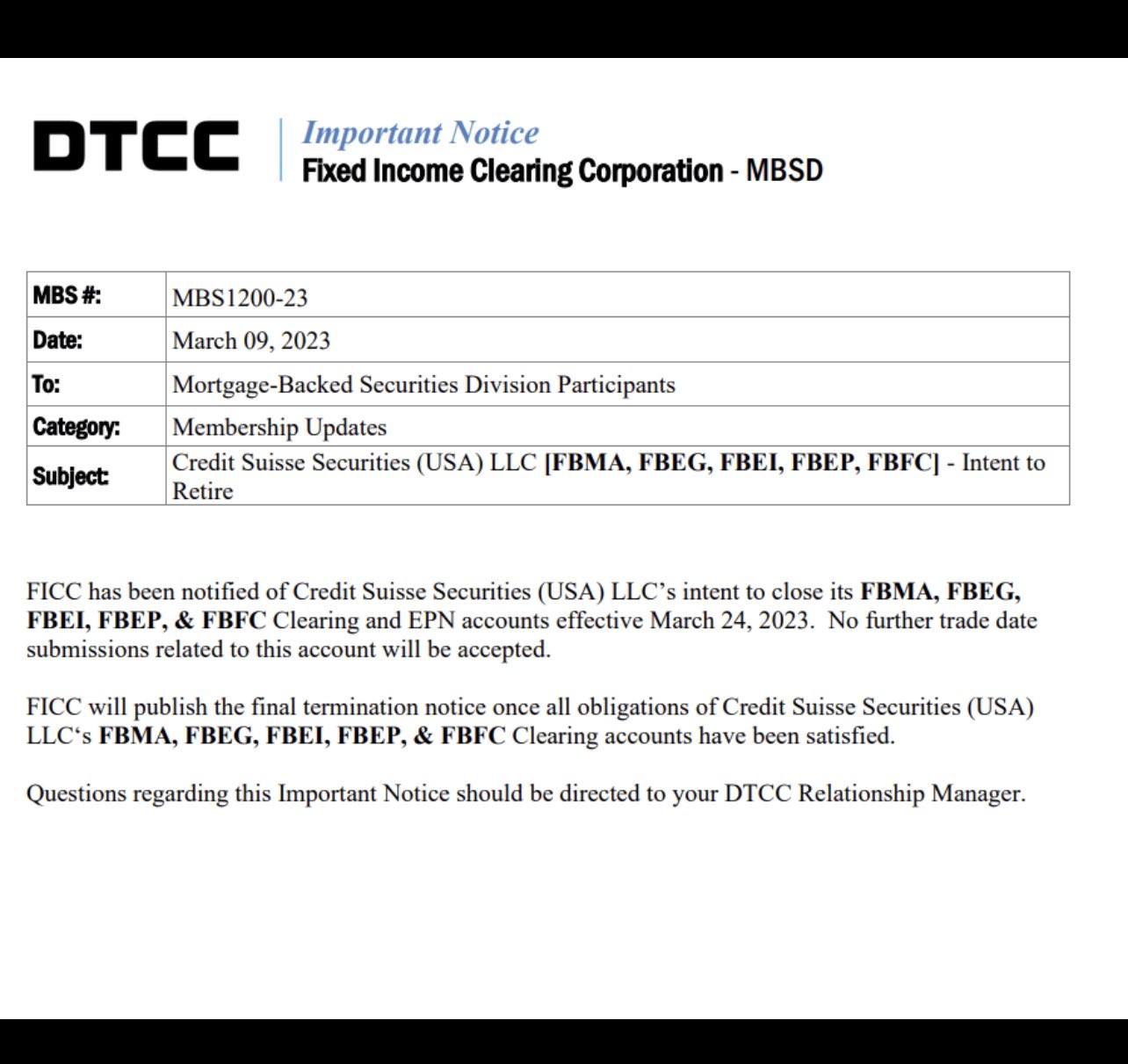

CREDIT SUISSE WINDING DOWN???

The Depository Trust & Clearing Corporation is an American post-trade financial services company providing clearing and settlement services to the financial markets. The organization posted THIS NOTICE about Credit Suisse yesterday:

This has left many people wondering if Credit Suisse is dead?

WELLS FARGO ISSUES?

Reports are coming in as of 7:46 AM EST of money missing in wells Fargo accounts this morning.

They are claiming a direct deposit issue. we will see.

STOCKS TOO!

Stock markets across Asia down 3%, German and French exchanges just open down 1.8% in minutes, London down 1.6%

Hold on to your hats!

Fed might be forced to reverse monetary policy next week!!

Black Friday …Black Monday??