In overnight futures trading, stocks dropped considerably but NOT disastrously, after the United States announced Reciprocal Tariffs on countries around the world. Expect a volatile day in Stock Markets as the effect of the new Tariffs becomes clear.

Some people might "panic" over this while others will rightly hold-the-line and see how this all shakes out. This is NOT a time for emotional reactions in stock and bond trading. This is a time for focused attention to details, and well-thought-out RESPONSES as opposed to REACTIONS.

The United States HAD TO do this. For decades, we have been exploited by countries all over the world which traded freely INTO our country, while deliberately EXCLUDING our products from THEIR country. That is coming to an abrupt end today.

Some folks are pointing to the Tariffs imposed before the Great Depression, but those comparisons are invalid. Those comparisons were based on the US being a gigantic EXPORTER of goods whereas today, we are the largest IMPORTER of goods.

The effect of our Tariff move will hit the countries shipping TO us If those countries relent and get fair, then our products will also flow INTO THIER countries which will have an enormous, positive effect here inside the US. More jobs. Better incomes. Lower prices.

Yes, there is going to be short term disruption and short term price changes. It should all be short-lived.

The key here is to not panic, and to make rational decisions for the long-term, based on the reality that the United States of America is the largest consumer market on earth and the countries shipping into the USA need our business.

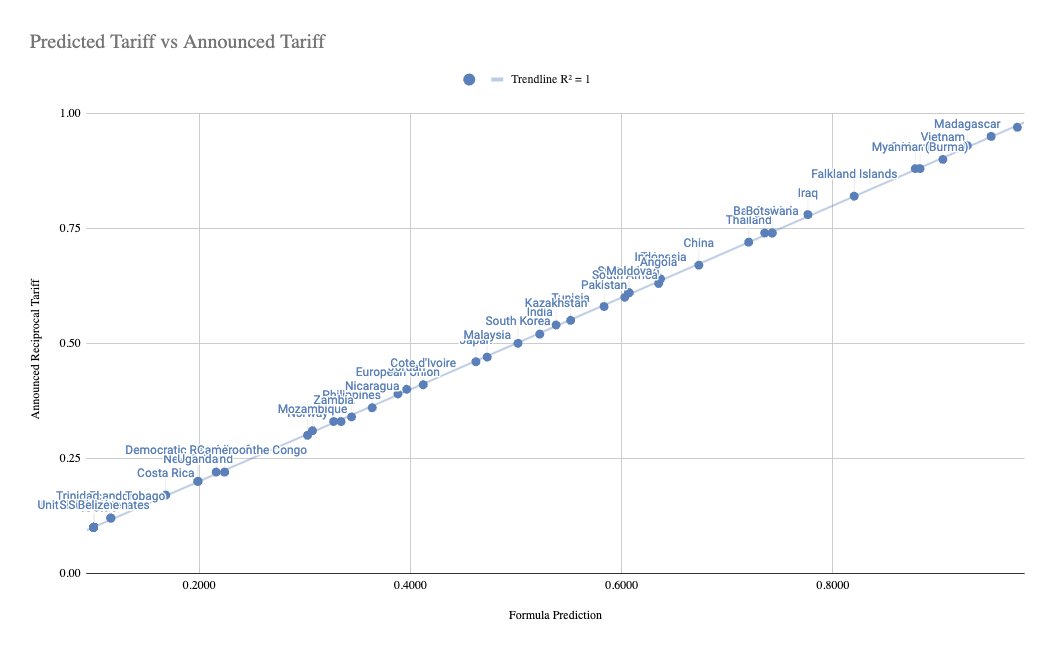

TARIFF FORMULA

A team was able to reverse engineer the formula the Administration used to generate the "reciprocal tariffs." It's quite simple: they took the trade deficit the US has with each country and divided it by imports from that country. The chart below shows the predictions of this formula plotted against the actual new tariff rates.