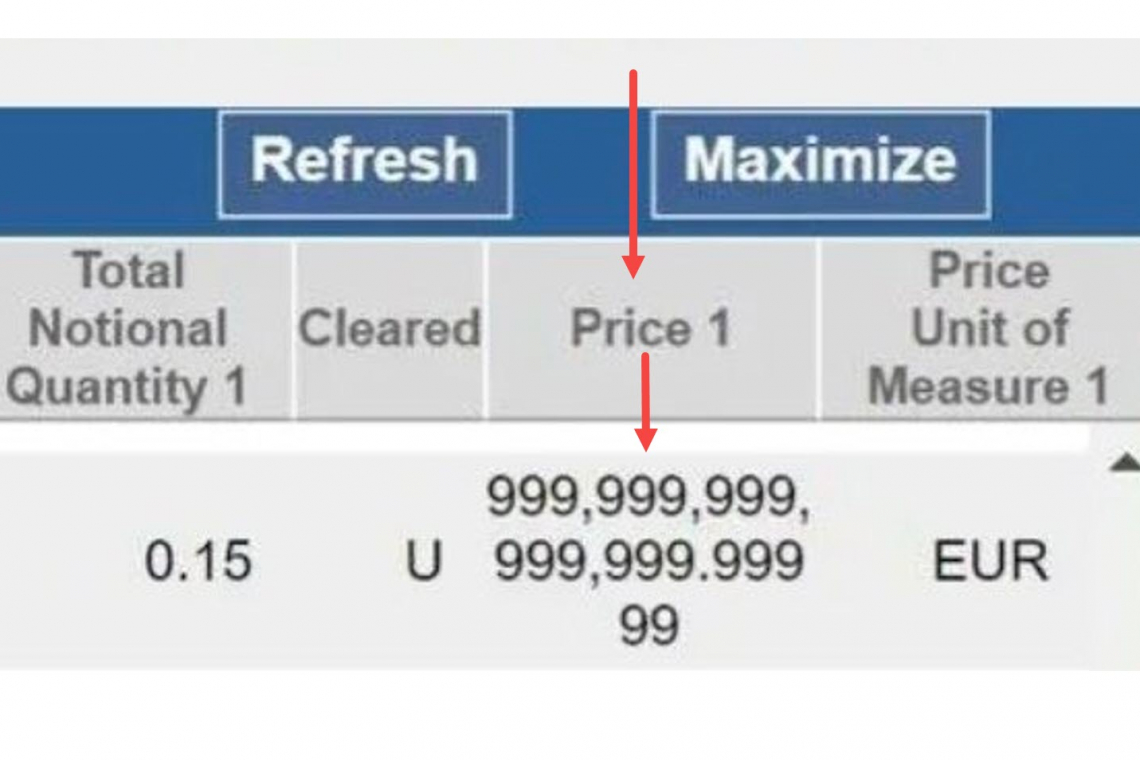

A Bank in Europe has, on its books, an "Equity Swap" valued at 999 TRILLION, 999 Billion, 999 million, 999 Thousand, 999 EUROS AND 99 EUROCENTS, with a listed "Notional" Value of 0.15 (or 15%) making the Bank exposure approximately 149 TRILLION EUROS, Expiring on December 15. Where will they get the money to settle?

The screen shot below shows the exact parameters of the UNCLEARED Equity Swap coming due December 15:

According to Google, an "Equity Swap is:

An equity swap is an exchange of future cash flows between two parties that allows each party to diversify its income for a specified period of time while still holding its original assets.

According to the Wikipedia, an Equity Swap is:

An equity swap is a financial derivative contract (a swap) where a set of future cash flows are agreed to be exchanged between two counterparties at set dates in the future. The two cash flows are usually referred to as "legs" of the swap; one of these "legs" is usually pegged to a floating rate such as LIBOR. This leg is also commonly referred to as the "floating leg". The other leg of the swap is based on the performance of either a share of stock or a stock market index. This leg is commonly referred to as the "equity leg". Most equity swaps involve a floating leg vs. an equity leg, although some exist with two equity legs.

An equity swap involves a notional principal, a specified duration and predetermined payment intervals.

Equity swaps are typically traded by delta one trading desks.

Examples

Parties may agree to make periodic payments or a single payment at the maturity of the swap ("bullet" swap).

Take a simple index swap where Party A swaps £5,000,000 at LIBOR + 0.03% (also called LIBOR + 3 basis points) against £5,000,000 (FTSE to the £5,000,000 notional).

In this case Party A will pay (to Party B) a floating interest rate (LIBOR +0.03%) on the £5,000,000 notional and would receive from Party B any percentage increase in the FTSE equity index applied to the £5,000,000 notional.

In this example, assuming a LIBOR rate of 5.97% p.a. and a swap tenor of precisely 180 days, the floating leg payer/equity receiver (Party A) would owe (5.97%+0.03%)*£5,000,000*180/360 = £150,000 to the equity payer/floating leg receiver (Party B).

At the same date (after 180 days) if the FTSE had appreciated by 10% from its level at trade commencement, Party B would owe 10%*£5,000,000 = £500,000 to Party A. If, on the other hand, the FTSE at the six-month mark had fallen by 10% from its level at trade commencement, Party A would owe an additional 10%*£5,000,000 = £500,000 to Party B, since the flow is negative.

For mitigating credit exposure, the trade can be reset, or "marked-to-market" during its life. In that case, appreciation or depreciation since the last reset is paid and the notional is increased by any payment to the floating leg payer (pricing rate receiver) or decreased by any payment from the floating leg payer (pricing rate receiver).

Equity swaps have many applications. For example, a portfolio manager with XYZ Fund can swap the fund's returns for the returns of the S&P 500 (capital gains, dividends and income distributions). They most often occur when a manager of a fixed income portfolio wants the portfolio to have exposure to the equity markets either as a hedge or a position. The portfolio manager would enter into a swap in which he would receive the return of the S&P 500 and pay the counterparty a fixed rate generated from his portfolio. The payment the manager receives will be equal to the amount he is receiving in fixed-income payments, so the manager's net exposure is solely to the S&P 500 (and risk that the counterparty defaults). These types of swaps are usually inexpensive and require little in terms of administration.

Applications

Typically equity swaps are entered into in order to avoid transaction costs (including Tax), to avoid locally based dividend taxes, limitations on leverage (notably the US margin regime) or to get around rules governing the particular type of investment that an institution can hold.

Equity swaps also provide the following benefits over plain vanilla equity investing:

- An investor in a physical holding of shares loses possession on the shares once he sells his position. However, using an equity swap the investor can pass on the negative returns on equity position without losing the possession of the shares and hence voting rights.

- For example, let's say A holds 100 shares of a Petroleum Company. As the price of crude falls the investor believes the stock would start giving him negative returns in the short run. However, his holding gives him a strategic voting right in the board which he does not want to lose. Hence, he enters into an equity swap deal wherein he agrees to pay Party B the return on his shares against LIBOR+25bps on a notional amt. If A is proven right, he will get money from B on account of the negative return on the stock as well as LIBOR+25bps on the notional. Hence, he mitigates the negative returns on the stock without losing on voting rights.

- It allows an investor to receive the return on a security which is listed in such a market where he cannot invest due to legal issues.

- For example, let's say A wants to invest in company X listed in Country C. However, A is not allowed to invest in Country C due to capital control regulations. He can however, enter into a contract with B, who is a resident of C, and ask him to buy the shares of company X and provide him with the return on share X and he agrees to pay him a fixed / floating rate of return.

Equity swaps, if effectively used, can make investment barriers vanish and help an investor create leverage similar to those seen in derivative products. However a clearing house is needed to settle the contract in a neutral location to offset counterparty risk.

Investment banks that offer this product usually take a riskless position by hedging the client's position with the underlying asset. For example, the client may trade a swap – say Vodafone. The bank credits the client with 1,000 Vodafone at GBP1.45. The bank pays the return on this investment to the client, but also buys the stock in the same quantity for its own trading book (1,000 Vodafone at GBP1.45). Any equity-leg return paid to or due from the client is offset against realised profit or loss on its own investment in the underlying asset. The bank makes its money through commissions, interest spreads and dividend rake-off (paying the client less of the dividend than it receives itself). It may also use the hedge position stock (1,000 Vodafone in this example) as part of a funding transaction such as stock lending, repo or as collateral for a loan.

Hal Turner Personal Analysis/Opinion

If I understand this correctly, at the expiration of the Equity Swap, both parties have to "square-up" with one paying the other the difference in value between what the items were worth when the swap was set up, and what they're worth now, or paying the Interest on the notional value of the swap.

On a Contract valued at €999,999,999,999,999.99, even with the "Notional" Value of 0.15, the Bank seems to be facing making-good on €149,000,000,000,000.00 (149 TRILLION) and as such, it seems to me there's some gigantic sum of money at stake.

Perhaps this is why a large bank in Europe has allegedly begun DENYING Withdrawals by Depositors? (Story Here) Are they now hoarding cash to try to be ready for settlement?

WHAT IF . . . .

What if this large and well known European Bank cannot "Square-up?"

How does the Banking system deal with a Failure involving €149 TRILLION in Derivatives?

I notice that the Expiration Date on the screen shot above, shows December 15. That's a Friday . . . how convenient!

What happens to the Banking system on that day? What happens over that weekend?

Do the banks even open on the following Monday?

It seems to me that something this large cannot be contained to the one Bank involved. It seems to me such a situation could have instant impact all over the planet; the ENTIRE Global Financial System!

What might that impact be?

What will happen to YOUR money in YOUR Bank when this deal "settles?"

SUPPLEMENTAL THOUGHTS 11:46 AM EDT --

I've been thinking about this much of today and I did more checking. There's a date on the screen shot above under "EVENT TIMESTAMP" that says January 19, 1970. I researched that date and found nothing of significance.

Then I wondered to myself, what if the screenshot above for the large European Bank is FINE for that Bank . . . but NOT FINE for the Counter-Party? What OTHER entity may face its day of reckoning on December 15 when this Equity Swap "expires?"

Maybe I'm looking at the wrong party to this Swap. Maybe the bank involved will make out like a bandit and someone ELSE will be hit?

Or will that someone else default and hit the bank above . . . and everyone else?

Too many unknowns.

Which leads me to the reality that all the bigshots have known about this date since at least the "PUBLICATION DATE" shown above, of March 3, 2021.

Could THIS gigantic transaction have anything at all to do with the aggressive actions of the US, the EU, and NATO against Russia, which lead-up to Russia sending its army into Ukraine a year later, in February 2022?

Certainly it has been the US and the West in general that has pushed and pushed and pushed Russia, in every way imaginable, almost as if they WANT World War 3.

Could THIS particular gigantic transaction be what unwinds the entire Global economy? Is THAT why the West has been pushing for war with Russia . . . . so they could blame the war for the failure of Global Finance smashing of the banks?

It is quite clear to me that as the Russia-Ukraine conflict continued, and despite all its red lines being crossed, Russia DID NOT resort to actions which would cause that war, I now wonder if could it be the powers that be needed something else?

Is THAT "something else" why the Israel-Hamas thing was set in motion? Perhaps to cause a regional war in the Middle East and BLAME the financial collapse that's coming on THAT war?

Or maybe I'm just totally wrong about this being a Global-Impact event?

One thing is for certain: If I am right . . . . and I have a sneaky suspicion that I am . . . whatever is going to happen over this, MUST happen within the next three weeks.

Hang-on folks, we could be in for a very rough ride.

MONTHLY FUND-RAISING

This entire web site and radio show is Reader/Listener Supported. Without YOU, this site goes dark. You don't get this kind of news, in-depth reporting, Covert Intelligence, and real-time coverage, anywhere else. This is one of the last media outlets that still tells the truth. If you like the truth, and want the actual facts, then please support this endeavor with a donation. I do this only once per month, in the final week of each calendar month, so as to survive for the next month. Without your help, right now, this site just dies. The truth goes with it. Please help!

For those of you who cannot or will not use online financial transactions, you can MAIL cash, check or Money Order to:

Harold Turner

P.O. Box 421

North Bergen, NJ 07047

USA