THIS STORY IS UPDATED AND CORRECTED 12:19 PM EDT -- SEE BOTTOM -- UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland. Co-headquartered in the cities of Zürich and Basel, it maintains a presence in all major financial centers as the largest Swiss banking institution and the largest private bank in the world. Yesterday, UBS appears to have FAILED-TO-DELIVER on Bonds that were due.

According to rapidly-spreading reports, not only has UBS Failed-to-Deliver on Bonds, but The Depository Trust and Clearing Corporation (DTCC) reportedly took action to COVER-UP the UBS Failure-to-Deliver; DTCC allegedly *** D E L E T E D *** the CUSIP Numbers for those bonds, so as a matter of record, those bonds "no longer exist." Apparently, they're simply "gone."

Lets begin with some basics.

What is the DTCC?

The Depository Trust & Clearing Corporation (DTCC) is an American post-trade financial services company providing clearing and settlement services to the financial markets.

It performs the exchange of securities on behalf of buyers and sellers and functions as a central securities depository by providing central custody of securities.

DTCC was established in 1999 as a holding company to combine The Depository Trust Company (DTC) and National Securities Clearing Corporation (NSCC). User-owned and directed, it automates, centralizes, standardizes, and streamlines processes in the capital markets. Through its subsidiaries, DTCC provides clearance, settlement, and information services for equities, corporate and municipal bonds, unit investment trusts, government and mortgage-backed securities, money market instruments, and over-the-counter derivatives. It also manages transactions between mutual funds and insurance carriers and their respective investors.

In 2011, DTCC settled the vast majority of securities transactions in the United States and close to $1.7 quadrillion in value worldwide, making it by far the highest financial value processor in the world. DTCC operates facilities in the New York metropolitan area, and at multiple locations in and outside the United States.

What is a CUSIP Number?

CUSIP stands for Committee on Uniform Securities Identification Procedures. A CUSIP number identifies most financial instruments, including: stocks of all registered U.S. and Canadian companies, commercial paper, and U.S. government and municipal bonds. The CUSIP system (formally known as CUSIP Global Services)—owned by the American Bankers Association and managed by Standard & Poor’s Global Market Intelligence—helps facilitate the clearance and settlement process of securities.

CUSIP numbers consist of nine characters (including letters and numbers) that uniquely identify a company or issuer and the type of financial instrument. A similar system is used to identify foreign securities (CUSIP International Numbering System or CINS). CINS employs the same nine character identifier as CUSIP, but also contains a letter in the first position to signify the issuer's country or geographic region.

Bond CUSIP Numbers DELETED . . .

According to reports coming out from the general public, the DTCC *** D E L E T E D *** the CUSIP Numbers for those UBS Bonds. Without CUSIP Numbers, there is no bond to buy, sell, or trade. It seems, the records of the money . . . are just . . . gone!

No CUSIP Number equals no Bond. No Bond equals no money for the Bondholder!

When a "Failure-To-Deliver" happens, BOTH sides in the transaction are __supposed__ to report it to authorities. There are FINES associated with Failure-to-Deliver. For instance, in a transaction with a $50 Million position, the fines are about $4166. PER DAY!

The government implemented these fines back in the year 2009. They implemented them because in the financial crisis of 2008, in October 2008 alone, some $16 TRILLION in Bonds alone, Failed-to-Deliver!

So why would DTCC not report these Failed-To-Deliver Bonds by UBS, and instead, just wipe them off the planet by DELETING the CUSIP Numbers? It's like the Bonds never existed!

Does this mean that UBS just doesn't have the money? Where did it go?

Does this mean that the financial markets are so corrupted they can actually control DTCC to get DTCC to cover up a massive failure to deliver? Is it so simple that when Bad Actors can't deliver on their bonds, they can just pick up the phone, call their buddies at DTCC, and have their buddies just ERASE them? Because that's what appears to have taken place; DTCC appears to have simply ERASED these Bonds as if they never existed.

Oh, and By the way . . . . If they didn't have the money to pay the bonds, it's a safe bet they also don't have the money to pay the fines, so it seems as though they just had the bonds ERASED by DTCC by deleting the CUSIP Numbers!

What Is Failure To Deliver (FTD)?

Failure to deliver (FTD) refers to a situation where one party in a trading contract (whether it's shares, futures, options, or forward contracts) doesn't deliver on their obligation. Such failures occur when a buyer (the party with a long position) doesn't have enough money to take delivery and pay for the transaction at settlement.

A failure can also occur when the seller (the party with a short position) does not own all or any of the underlying assets required at settlement, and so cannot make the delivery.

KEY TAKEAWAYS

- Failure to deliver (FTD) refers to not being able to meet one's trading obligations.

- In the case of buyers, it means not having the cash; in the case of sellers, it means not having the goods.

- The reckoning of these obligations occurs at trade settlement.

- Failure to deliver can occur in derivatives contracts or when selling short naked.

Understanding Failure To Deliver

Whenever a trade is made, both parties in the transaction are contractually obligated to transfer either cash or assets before the settlement date. Subsequently, if the transaction is not settled, one side of the transaction has failed to deliver. Failure to deliver can also occur if there is a technical problem in the settlement process carried out by the respective clearinghouse.

Failure to deliver is critical when discussing naked short selling. When naked short selling occurs, an individual agrees to sell a stock that neither they nor their associated broker possess, and the individual has no way to substantiate their access to such shares. The average individual is incapable of doing this kind of trade. However, an individual working as a proprietary trader for a trading firm and risking their own capital may be able. Though it would be considered illegal to do so, some such individuals or institutions may believe the company they short will go out of business, and thus in a naked short sale they may be able to make a profit with no accountability.

Subsequently, the pending failure to deliver creates what are called "phantom shares" in the marketplace, which may dilute the price of the underlying stock. In other words, the buyer on the other side of such trades may own shares, on paper, which do not actually exist.

Chain Reactions of Failure to Deliver Events

Several potential problems occur when trades don't settle appropriately due to failure to deliver. Both equity and derivative markets can have a failure to deliver occurrence.

With forward contracts, a party with a short position's failure to deliver can cause significant problems for the party with the long position. This difficulty happens because these contracts often involve substantial volumes of assets that are pertinent to the long position's business operations.

In business, a seller may pre-sell an item that they do not yet have in their possession. Often this will be due to a delayed shipment from the supplier. When it comes time for the seller to deliver to the buyer, they can't fulfill the order because the supplier was late. The buyer may cancel the order leaving the seller with a lost sale, useless inventory, and the need to deal with the tardy supplier. Meanwhile, the buyer will not have what they need. Remedies include the seller going into the market to buy the desired goods at what may be higher prices.

The same scenario applies to financial and commodity instruments. Failure to deliver in one part of the chain can impact participants much further down that chain.

During the financial crisis of 2008, failures to deliver increased. Much the same as check kiting, where someone writes a check but has not yet secured the funds to cover it, sellers did not surrender securities sold on time. They delayed the process to buy securities at a lower price for delivery.

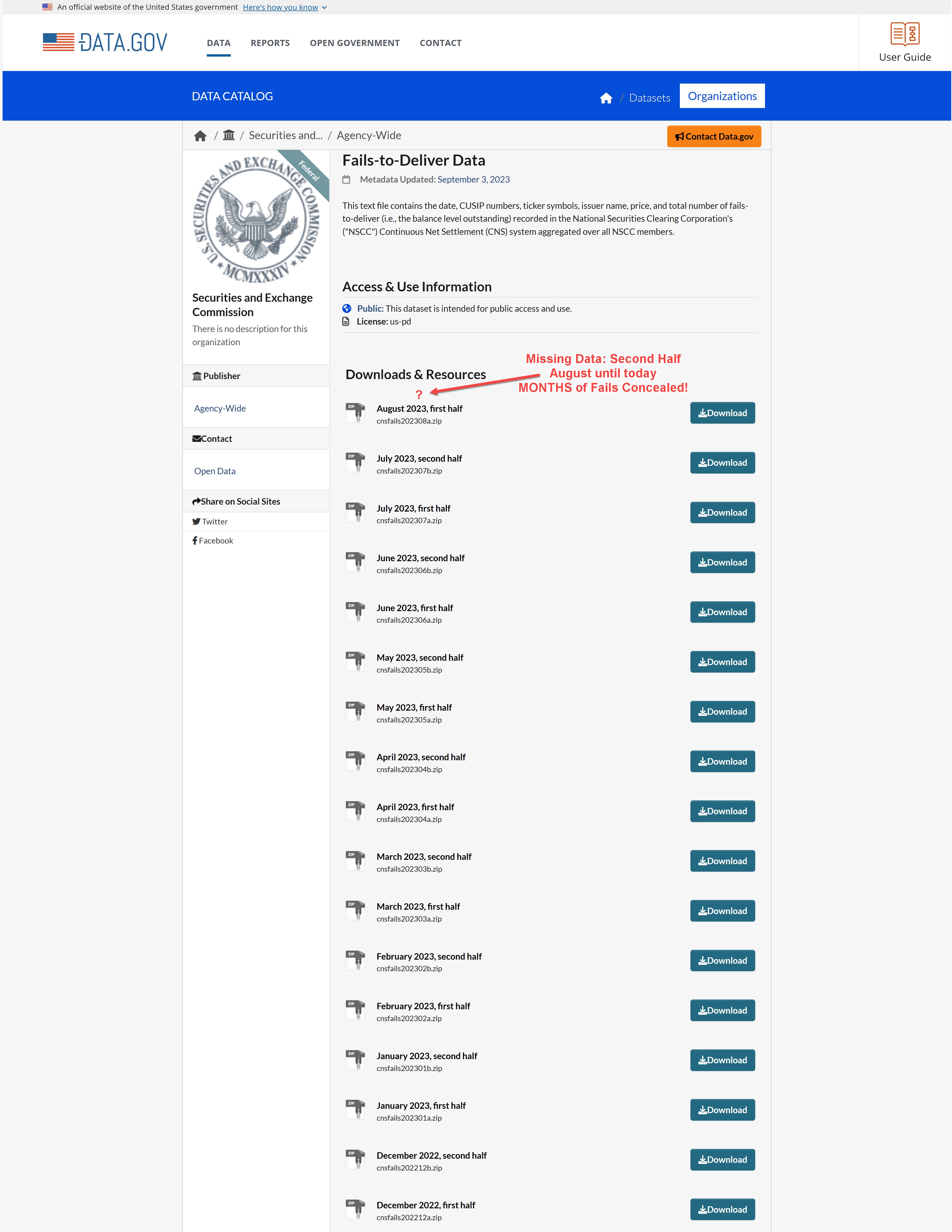

SEC "FTD" List - Concealed Since September

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation.

Among its vast reporting to the Public, the SEC provides reports, TWICE A MONTH, of all "Failed-To-Deliver (FTD)" occurrences. They have provided this report, twice a month, for YEARS.

On the First of each month, they report the last two weeks of the prior month. On the 15th of each month, they report the second two weeks of each prior month.

In August, 2023, the SEC didn't publish the second report, which would have covered the last two weeks of July, 2023,

Then the SEC didn't report FTD's at all for September, October, or even the first two weeks of this month, November!

THE SEC APPEARS TO BE CONCEALING THE FAIL-TO-DELIVER INFORMATION.

Here. Look:

UPDATE 12:19 PM EDT --

I have been corrected regarding the SEC info above, which is now struck-through.

The S.E.C. **moved** its Fail-to-deliver reporting to a different page on their website. The correct page is:

https://www.sec.gov/data/foiadocsfailsdatahtm

The SEC is **NOT** concealing the data. All of it is reported. I apologize for this error.

ANALYSIS

<Mention of SEC - Deleted per correction above>

I interpret the actions taking place by UBS, the DTCC, to be a massive indication that the financial system is in actual, real, un-stoppable, collapse.

The Banks and Securities firms don't want the public knowing because once the information comes out, they are forced into Bankruptcy and their gravy train is over. The government doesn't want the public knowing, because once it comes out, and financial institutions go belly-up, the government gets saddled with potentially TRILLIONS of Pay-outs . . . and the US Government is already broke.

So rather than admit the entire financial system is in actual, unstoppable collapse, they appear to be concealing the information, going-on as usual and perhaps intend to keep doing that until the defaults are so massive, the failures-to-deliver as so big, they simply cannot hide it anymore. I suspect, on that day, the system will simply STOP. Everything will be shut down. No money. No credit. No nothing.

Once the entire system collapses, the planet goes into the single most massive economic depression in the history of human existence. People's pensions, IRA's bank accounts, are all wiped out.

I believe it would likely cause violent mayhem. I suspect there would be bloodshed on a level never before seen, as angry citizens, who have lost everything they worked for, hunt down, ambush, and intentionally kill, all the people who did this. If such "street justice" were to take place, I wouldn't shed a tear for those killed; I would simply think "they brought it all on themselves."

Folks, it seems to me, this does not end well . . . and in my personal opinion, the end is very, very, near.

I am not a licensed financial professional and I cannot give financial advice. You should not make any financial decisions based on my reporting. You should consult with a licensed financial professional before making any financial decisions or transactions.

I can, however, report the news and to me, THIS is news.

For me personally, I am taking my money OUT of their systems. Cash. As much as I can get each day, every day, until it's out.

I don't have much. But what I have, I worked hard to get. I am not going to let what appears to me to be a totally corrupt system, rob me of what I worked so hard to earn.

MONTHLY FUND-RAISING

This entire web site and radio show is Reader/Listener Supported. Without YOU, this site goes dark.

You don't get this kind of news, in-depth reporting, Covert Intelligence, and real-time coverage, anywhere else.

This is one of the last media outlets that still tells the truth.

If you like the truth, and want the actual facts, then please support this endeavor with a donation.

I do this only once per month, in the final week of each calendar month, so as to survive for the next month. Without your help, right now, this site just dies. The truth goes with it.

Please help!