In the past 150 years, the US Money Supply has only contracted five (5) times; and they were Recessions and the Great Depression. It is happening again.

Two U.S. money supply metrics that investors tend to pay close attention to are M1 and M2. The former accounts for the cash and coins in circulation, as well as the demand deposits within an individual's checking account. Meanwhile, M2 factors in everything in M1 and adds money market accounts, savings accounts, and certificates of deposit (CDs) below $100,000. The main difference is that M2 factors in cash that takes a little extra work to get your hands on.

For as far back as the eye can see, M2 has been climbing. Since the U.S. economy steadily grows over the long run, it's only natural that more cash/capital is needed to facilitate transactions. In fact, M2 rising is so common that some economists may not even be paying attention to it as a monthly reported datapoint.

But in the rare event that M2 meaningfully declines, pay attention!

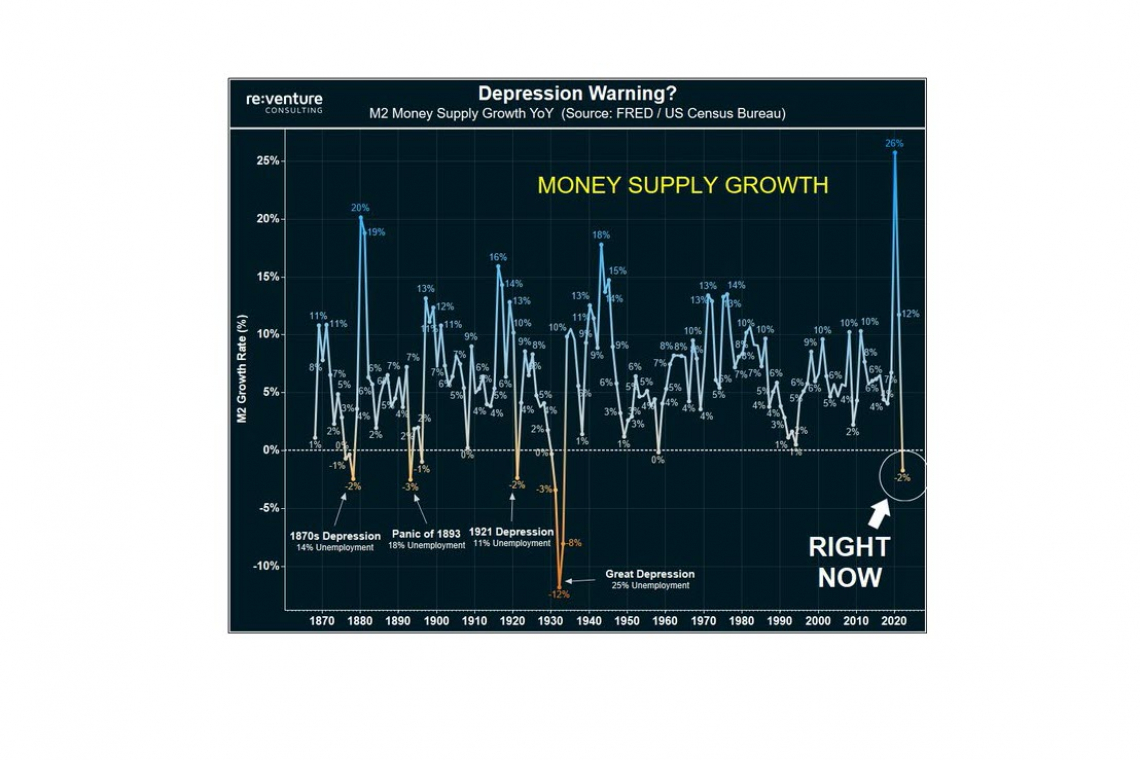

Back in March, Reventure Consulting CEO Nick Gerli posted what you see below on X, the social media platform formerly known as Twitter. It highlights M2 money supply growth and contraction dating back to 1870 using data supplied by the St. Louis Federal Reserve and the U.S. Census Bureau.

Over the past 153 years, there have only been five instances where M2 has declined by at least 2% on a year-over-year basis: the 1870s, 1893, 1921, 1931-1933, and 2023. In order, these instances resulted in a depression, panic, depression, Great Depression, and (insert your best guess here). In the previous four instances, it was an ominous sign for Wall Street.

WARNING: the Money Supply is officially contracting. 📉

— Nick Gerli (@nickgerli1) March 8, 2023

This has only happened 4 previous times in last 150 years.

Each time a Depression with double-digit unemployment rates followed. 😬 pic.twitter.com/j3FE532oac

As of July 2023, M2 money supply was 3.69% below the all-time high recorded in July 2022. This marks the first time since the Great Depression that we've witnessed a meaningful decline in U.S. money supply.

To be completely fair, the declines in the 1870s and 1893 occurred prior to the creation of the Federal Reserve, while the drops in 1921 and during the Great Depression came shortly after its creation. Today, there's a far better understanding from the nation's central bank and Capitol Hill on how to utilize monetary policy and fiscal policy, respectively, to avoid a depression.

Furthermore, multiple rounds of fiscal stimulus during the COVID-19 pandemic led M2 money supply to catapult higher by 26% on a year-over-year basis. It's always possible that the decline we're witnessing now of 3.69% represents nothing more than a return to some sort of mean after a historic expansion of M2.

However, history has been unkind to meaningful M2 money supply declines. With the core inflation rate more than double the Fed's long-term target of 2%, less capital in circulation would more than likely lead to a deflationary recession.

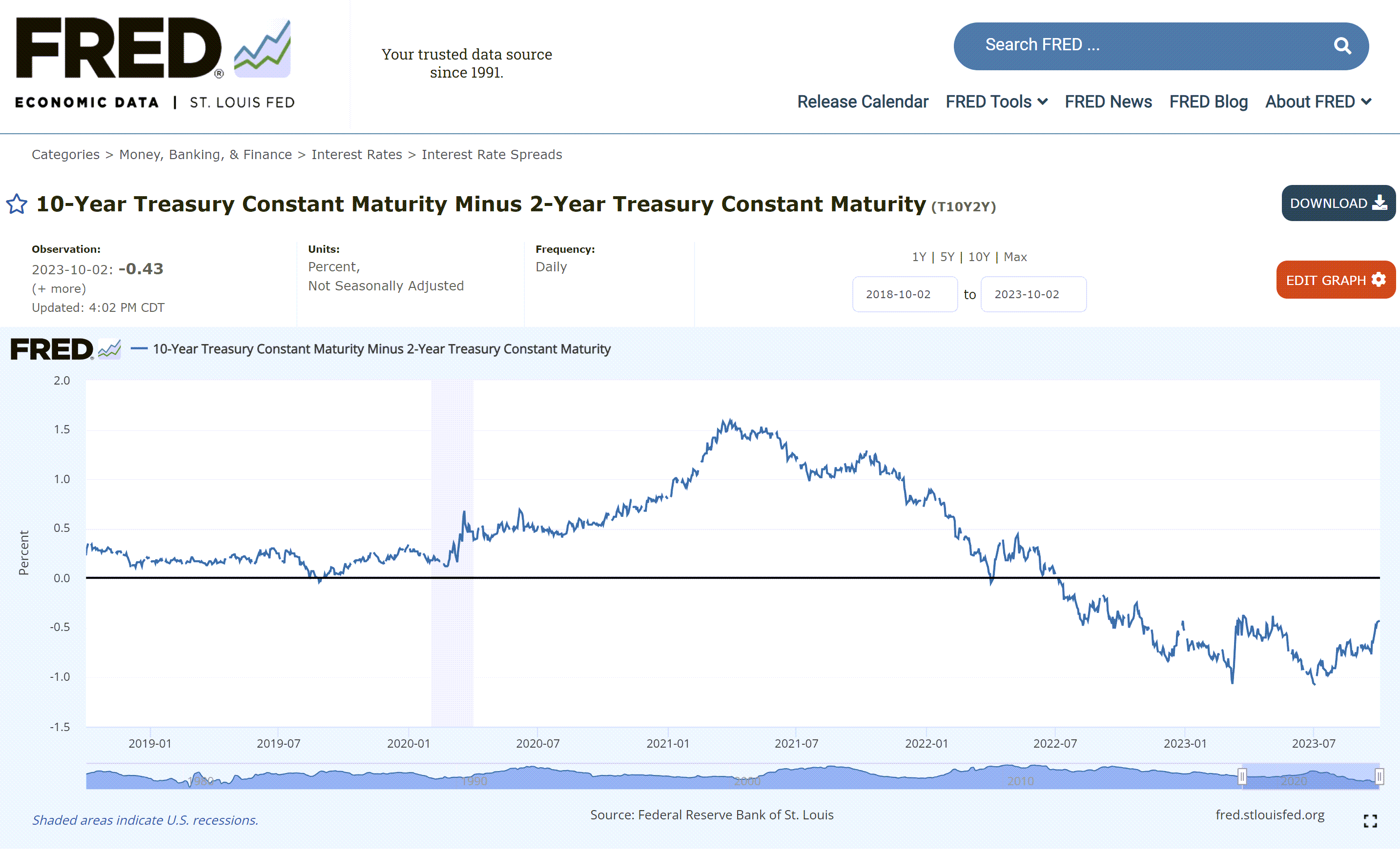

YIELD CURVE INVERTED - 1 YEAR +

Add into the above facts, the reality that the yield curve, as reported by the Federal Reserve, has been inverted for over a year, and you've got the makings of financial disaster:

As you can see on the chart above, the yield curve is now starting to normalize.

The crash ALWAYS comes after it normalizes.

And when the yield curve is inverted for an extended period of time, the crash is bigger and harder.

UPDATE 10:05 AM EDT --

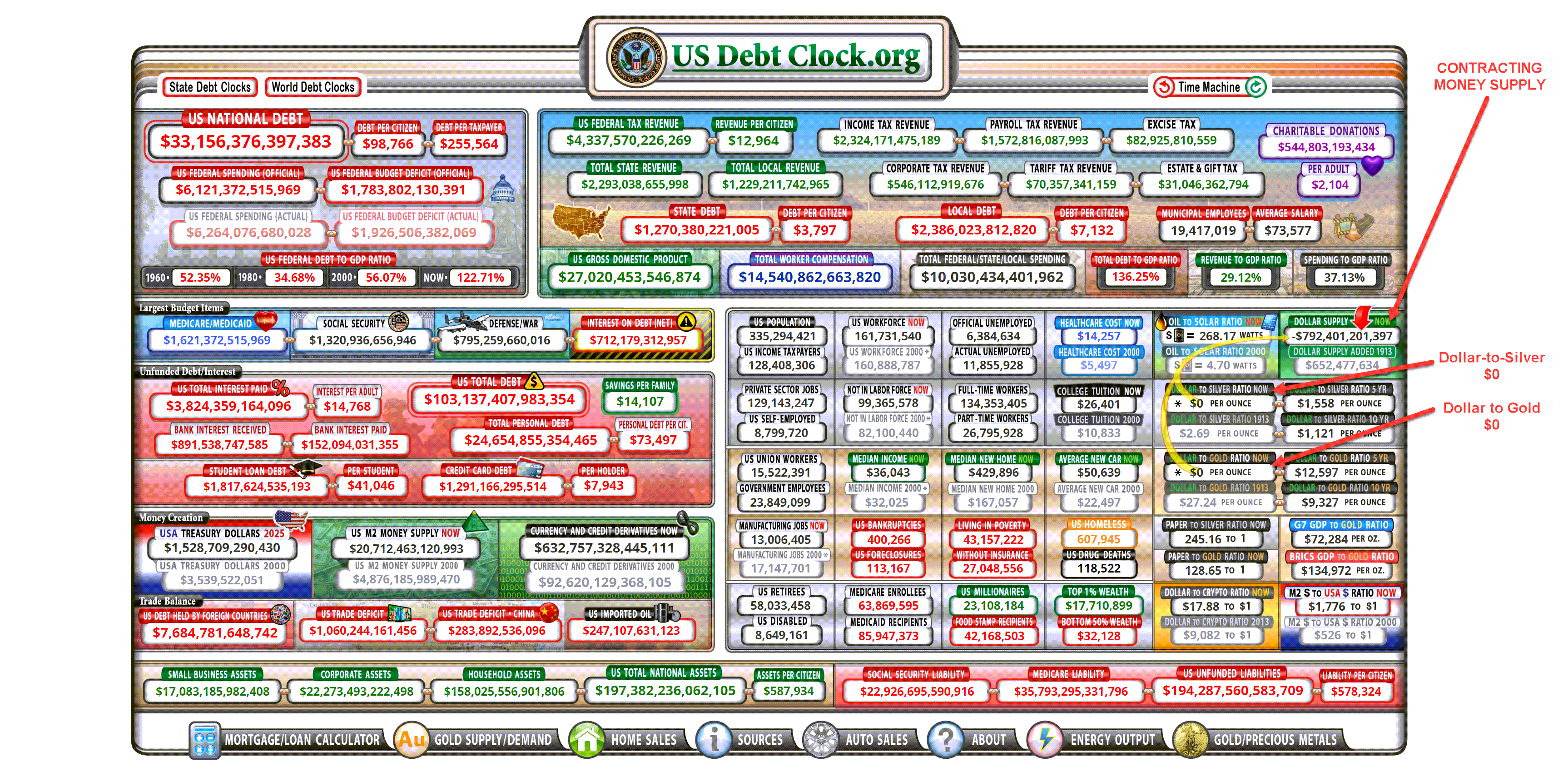

Here is the Debt Clock:

The LIVE version is HERE

Not only is the US Money Supply CONTRACTING, the value of the US Dollar to Silver . . . . $0 and The value of the US Dollar to Gold . . . $0

TREASURY BOND CARNAGE

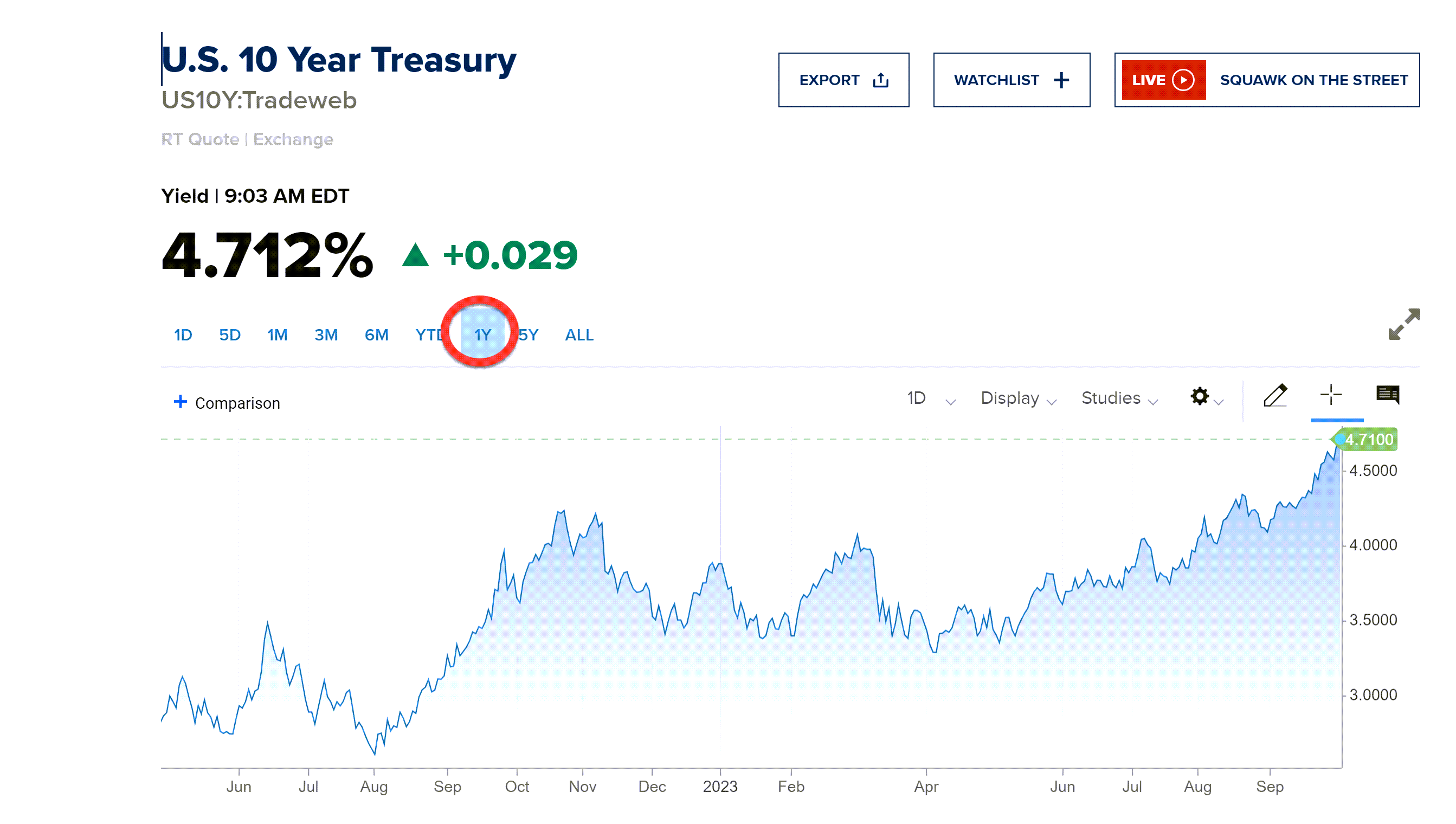

The Ten Year Bond is going Vertical . . . Look:

Direct LIVE link HERE

Why is this happening, you ask? Because NO ONE wants to lend money to the US for a long term anymore. The US is so in debt, people have lost faith in its ability to repay. So the Treasury is having to offer MUCH higher interest rates just to get people to lend them money.

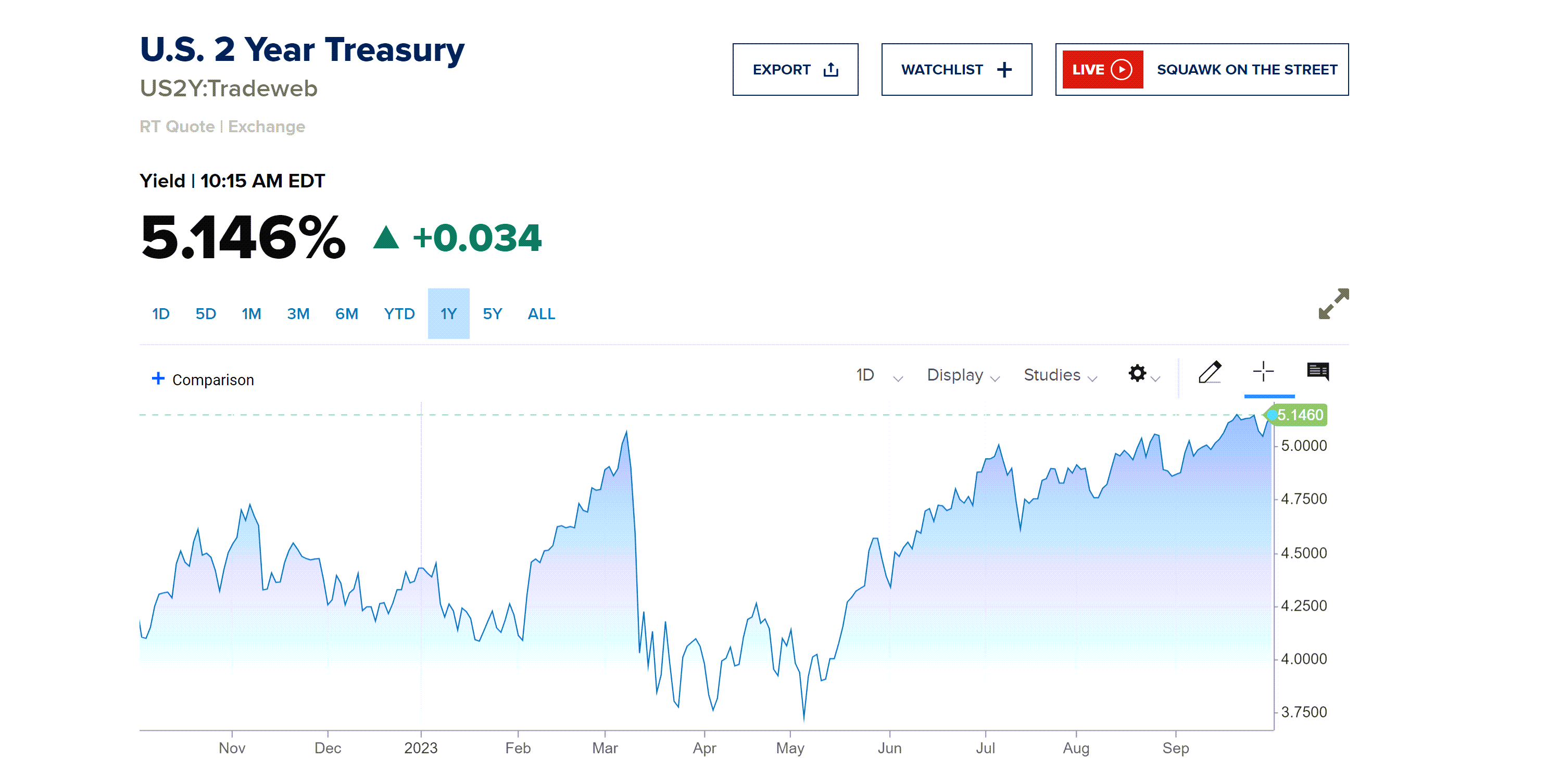

Meanwhile, the short term Bonds are Flat or Dropping as seen below because more people are interested in short term loans; no faith in the long term.

Direct Link LIVE Here

HAL TURNER ANALYSIS

OK, so what does all this actually MEAN to you and me? I found some of this information in comments on the web, by people who know a lot more about this stuff than I do. I found their remarks worth repeating here.

THE YIELD CURVE COULD NORMALIZE AT ANY TIME, MAYBE EVEN TODAY.

After that, combine the contracting money supply with high inflation and . . . MEGA DOOM

The way I see it . . . . it's literally THE END. The US economy is 100% kaput

The last time this happened, they talked the Boomer's parents into sending their kids to die overseas to fight Communism and Socialism. Kids by the millions coming home in body bags and idiot parents posting yellow stars in their windows so everyone could tell them how brave their kids were for fighting Nazis and Communists, when actually they were just covering up what they did to the Weimar Republic.

All for what? So the Bankers could move here en-masse and take over the west while telling us we won, and then spend the next century raping an pillaging our society too, like a plague of locusts.

You think they're going to get their Draft and War this time? I'm not sure bout that. Most everyone knows that Ukraine is a money laundering operation for them to get the rest of the loot out and convert the dollars to something useful before the crash becomes obvious to the pleebs.

This is why the "Elite" are building bunkers.

This is why they have a puppet instead of a real leader in Washington.

It's why they have fences around the US Capital.

It's why they don't seem to care if anyone sees their crimes and greed right now.

They think we're stupid, and I'm willing to bet that most people don't get what the money supply running backward on the debt clock means, except for you folks who visit this web site.

They want us to give up our kids IN Ukraine.

Well, my position on that is simple: no gold star for this Dad.

They want us on Central Bank Digital Currency (CBDC) and to own nothing. This is how they figure on doing it, another great depression and another World War. Just straight up evil.

They'll give us another "New Deal"

This time, the Green New Deal.

They'll talk about how dirty money spreads disease (COVID), pushes illegal drug sales (they Kensington St. in Philly is on a 24/7 youtube feed...it's propaganda), how it causes global warming (the Maui lasers...oops, excuse me, I meant entirely accidental fires), etc.

They figure once they get us on the digital currency, that's it. They can do whatever they want with us forever.

And forget ever having a fucking independent retirement. Any money you save will be squandered with inflation. Perhaps they even intend to make gold and silver worthless because there's no way to buy or sell it without cash.

We need to say NO to this New Deal, and shove it right back down their evil throats with a simultaneous boot up their ass.