There must have been very big and very nasty details on the books of Credit Suisse; UBS has agreed to buy its rival for only $3.2 BILLION. Prior, Credit Suisse has a Market Capitalization of about $7 BILLION. So the UBS buy is less than $1 a share!

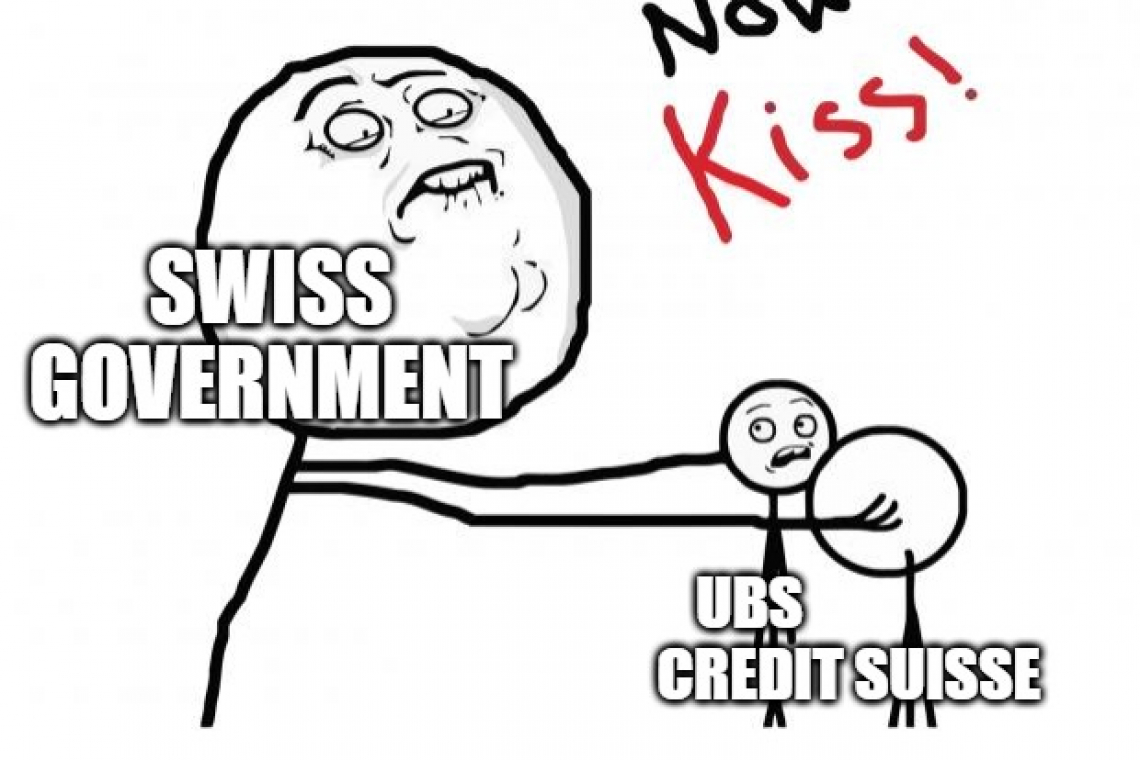

UBS agreed to buy its embattled rival Credit Suisse for 3 billion Swiss francs ($3.2 billion) Sunday, with Swiss regulators playing a key part in the deal as governments looked to stem a contagion threatening the global banking system.

“With the takeover of Credit Suisse by UBS, a solution has been found to secure financial stability and protect the Swiss economy in this exceptional situation,” read a statement from the Swiss National Bank, which noted the central bank worked with the Swiss government and the Swiss Financial Market Supervisory Authority to bring about the combination of the country’s two largest banks.

The terms of the deal will see Credit Suisse shareholders receive 1 UBS share for every 22.48 Credit Suisse shares they hold.

“This acquisition is attractive for UBS shareholders but, let us be clear, as far as Credit Suisse is concerned, this is an emergency rescue. We have structured a transaction which will preserve the value left in the business while limiting our downside exposure,” said UBS Chairman Colm Kelleher in a statement.

The combined bank will have $5 trillion of invested assets, according to UBS.

Hal Turner Opinion

Saudis are not going to be happy about this at all.

Considering that shareholders didn't even get a vote (against the law?), I would think that they see the writing on the wall and begin selling off assets as quickly as possible.

I suspect they are going to instigate a run for the exits, and with their size they will not wait to do it slowly.

Tomorrow is going to be a very, very interesting day.

Assuming that UBS Credit Default Swaps (CDS) don't jump 100bps and nullify the deal... and I suppose even if they do, the Swiss National Bank will just change the contract and force it down their throat any way.

This was ugly!

Credit Suisse is no more. It technically collapsed, then the govt. changed the laws in real-time and made UBS buy it with a bailout. They broke the law and refused to allow the rightful owners (shareholders) to UBS to vote, and dictated the sale... rule's and law be dammed.

The entire western system is now a joke and fraud. They rig the rules to their favor, no one goes to jail, and all the shareholders just got robbed for billions.

You know what I think? I think what we're all NOT seeing is the chess moves. These banks are ALL interlinked with derivatives and counter-party risk. All these banks have been cross-trading and leveraging against each other. One goes down, they all go down.

UBS is the hatchet man for CS. They need one bank to absorb the toxic debt, and UBS needs to present a mask of safety for capital and investment holders when CS is officially retired.

All the banks are cutting off one finger at a time. It’s all misdirection. Europe will burn this summer.

P. S. The credit default swaps are already crushing! CDS for UBS is going through the roof now - over 300BP at moment and rising like rocket. Stock market will be fun tomorrow.

UPDATE 6:09 PM EDT--

JUST IN: About 16 billion Swiss francs ($17.3 billion) of Credit Suisse, $CS, bonds have become worthless after takeover by UBS.

This announcement from the Swiss Financial Monetary Authority (FINMA):

"Credit Suisse has been informed by FINMA that FINMA has determined that Credit Suisse’s Additional Tier 1 Capital (deriving from the issuance of Tier 1 Capital Notes) in the aggregate nominal amount of approximately CHF 16 billion will be written off to zero."

HT REMARK: I don't want to be seen as some sort of "Chicken Little the sky is falling" but do all of you realize what this has done? The rules are no longer the rules in the West. The law is no longer the law. The Saudis and other investors have just watched the rules and the law go literally out the window in this situation, and they are left holding the bag of almost worthless stock and literally worthless bond paper.

If YOU were the Saudis/Arabs and YOU had hundreds of billions of your oil profit money sitting in western banks, what would YOU do right now? Yep. Pull it all. Because it's clearly no longer safe. It can be grabbed by the West, with no notice and no recourse, within seconds. On a weekend, even!

If the Saudis and Arabs come to the same conclusion that I just did, then this is now realistically what we can all expect: A real-life rendition of the 1981 movie "Rollover" starring Kris Kristofferson, Jane Fonda and Hume Cronin. In that movie, Arabs pulled all their money from western banks, and the entire monetary system collapsed. All the money gone.