To average, everyday people, the failure of Credit Suisse is simply some news headline. They have no clue at all what this means: ALERT - Time's up. Why? Because Credit Suisse was a "Bulge Bracket Bank." You may know it better as "too big to fail." But fail it has.

What is a bulge bracket bank?

A bulge bracket bank refers to a top-tier, multinational investment bank that has a leading role in the global financial markets. The term "bulge bracket" originally referred to the banks listed at the top of the "league tables" for securities underwriting, but it has since come to encompass a wider range of financial services.

Bulge bracket banks typically have a strong presence in both the domestic and international markets, providing a broad range of services such as underwriting, M&A advisory, equity and debt offerings, and sales and trading of securities. They also typically work with large, high-profile clients such as corporations, governments, and institutional investors.

Examples of bulge bracket banks include Goldman Sachs, JPMorgan Chase, Morgan Stanley, Bank of America Merrill Lynch, Citigroup, and Deutsche Bank. These banks are known for their extensive resources, large-scale operations, and high-profile deals.

What banks are considered bulge bracket?

Some of the banks that are considered bulge bracket are:

JPMorgan Chase & Co.

Goldman Sachs Group, Inc.

Morgan Stanley

Bank of America Merrill Lynch

Citigroup, Inc.

Deutsche Bank AG

rclays PLC

Credit Suisse Group AG

In fact, UBS Group AG

Wells Fargo & Co.

These banks are considered bulge bracket because they typically have a leading role in the global financial markets and provide a wide range of financial services to large, high-profile clients such as corporations, governments, and institutional investors. They are also known for their extensive resources, large-scale operations, and high-profile deals.

What would happen if a bulge bracket bank failed?

If a bulge bracket bank were to fail, it could have serious repercussions on the global financial system and the broader economy. This is because these banks are deeply interconnected with other financial institutions and play a significant role in the global financial markets.

If a bulge bracket bank were to fail, it could trigger a domino effect that would lead to other financial institutions experiencing financial distress or failing. This could lead to a credit freeze, where access to credit is severely restricted, making it difficult for businesses and individuals to obtain financing. This, in turn, could lead to a slowdown in economic activity and a recession.

To prevent such a scenario, regulators have put in place various measures to monitor and regulate the activities of bulge bracket banks. For example, these banks are subject to more stringent capital and liquidity requirements, stress tests, and other regulations to ensure their financial stability and resilience. In the event of a failure, regulators may also intervene to stabilize the financial system and protect the broader economy from the fallout of a bank failure.

Credit Suisse Failed

Those measures do NOT seem to have worked. Reverberations from the Credit Suisse failure, and the utterly vicious zeroing of Credit Suisse "Tier A1" Bonds, is starting to spread.

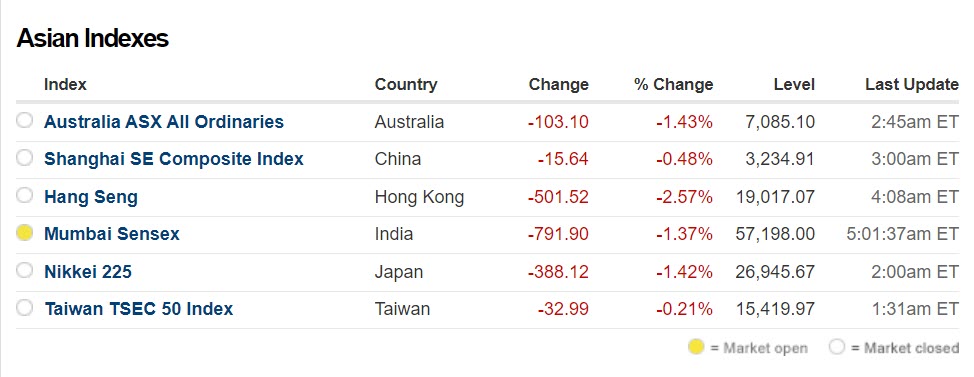

As this story is written at 4:45 AM on 20 March 2023, Asian Stock Markets have almost completed their trading day. They're all in the red:

Credit Suisse, $CS, was worth $10 billion a month ago and sold for pennies on the Dollar.

The government said $CS had “serious risk of bankruptcy.”

A shareholder vote was bypassed.

Regulators knew it was a matter of hours for bankruptcy.

This deal was made out of desperation.

In fact, the "rescue" was not a rescue. UBS could only work an equity trade, they themselves lacked the cash for a real buyout! That deal was total clown world.

Stock Markets know this. Stock Holders are learning of it now. The markets will begin to react TODAY.

Europe is opening shortly. That's where we will see some of the Credit Suisse fallout.

In the Asian Markets HSBC & Standard Chartered both down 6%.... will be interesting to watch the European markets when they open.

US markets open in about 3.5 hours. As Europe goes, so will the US.

You see, those "Tier 1A "Bonds that were Zeroed for Credit Suisse . . . they totaled slightly over seventeen billion dollars. Somebody has now lost all that money. Well, a lot of somebody's, actually.

That loss is going to have an impact. Maybe an impact on someone big. And that may take THEM out.

Moreover, the zeroing of Tier 1A Bonds just showed bondholders all over the world, that when it comes to BANKS, their "totally secure" Tier 1A bonds, aren't nearly as secure as they were lead to believe! People are going to start dumping those bonds, because clearly, they're now far riskier than anyone ever thought.

When you factor-in the reality that the Swiss government changed their law in real-time, to prevent Credit Suisse stockholders from having the Statutory 6 weeks to consider a merger or buyout offer, the bondholders (and Stock holders) now know they're sitting ducks. They have NO PROTECTION of law. The "rules" went right out the window.

As these Bond holders (and maybe stock holders) run for the exits today - and this week - their selling is going to put the banks under even MORE pressure.

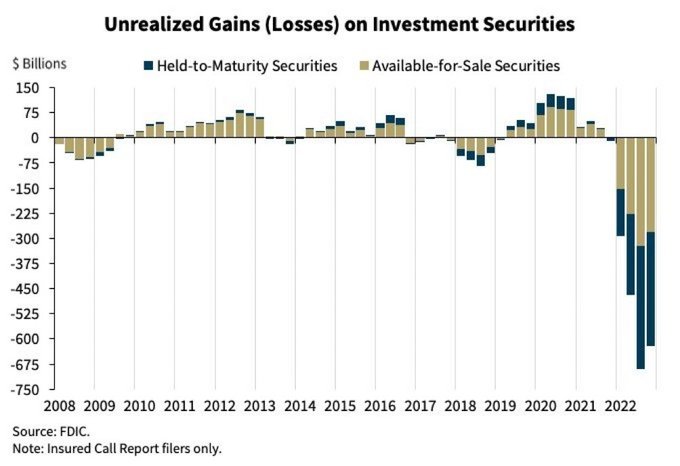

In the US, here's how fragile the banks actually are:

At the far right of the chart is this year - right now. As you can see, the banks are stuck holding Bonds that are worth LESS than their face value. In the color gold, those bonds can be sold by the banks if the banks need to raise cash. Those gold-colored (sellable) bonds are worth three-hundred BILLION dollars LESS than their face value.

As long as the banks don't have to sell them (to raise cash) the loss on the bond is "unrealized." But as people begin to take more money out of the banks, because the general public sees the banks as untrustworthy, some banks are going to HAVE TO sell those bonds. And the moment they do, the loss becomes "realized" and the bank is in trouble.

This week may very well be historic. We just don't know how it will turn out.

Politicians all over the world are screaming from the rooftops that "the banks are safe and secure." Trouble is, the public long ago learned that when they tell you things are safe, that's when you run!

Because politicians and government officials have shown themselves to be liars, over and over , and over again. Only the truly stupid believe them anymore.

With that reality, there's no telling what will happen this week. However . . . Calamity . . . is on the menu.

This isn't going away.

This is not your typical msm-driven race-baiting, class warfare, type of drivel designed to distract you from real problems.

This is a real problem. They're going to try to keep your eyes - and mind - off of it with crap like North Korea nuclear threats, Trump's impending arrest, etc. Expect some race-fueled incident to really throw everyone over the edge.

If they can keep us worked up over things like that, maybe we won't notice all the banks failing and the economy literally crumbling around us. Maybe.

This isn't something they can bury and hide for long, though, but they will try to keep us in the dark as long as possible. Many won't notice until bank failures and sky-high inflation impacts them personally.

When they know you notice the real problem, like with the Credit Suisse-UBS merge, they'll issue some statement about how all is well and good, the US dollar is strong and we shouldn't worry. When they say this kind of nonsense is when you need to worry the most.

UPDATE 5:20 AM EDT --

European market:

UBS - 12%

Deutsche -10%

most others -8%

people do not believe their lies anymore . . . this is a bad omen for everything today . . . .

Shares in European banks drop sharply despite emergency rescue deal for Credit Suisse and swift action by regulators

— BBC Breaking News (@BBCBreaking) March 20, 2023

Live updates https://t.co/2kY4iBWp2M

UPDATE 5:31 AM EDT --

They just talked on Bloomberg about "the possibility of UBS walking out of the deal."